Bank of Maldives (BML) Islamic has introduced its first home financing products on Wednesday.

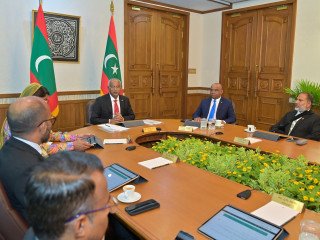

BML Islamic’s Home Construction and Real Estate Financing facilities were launched at a ceremony held today at BML headquarters in Malé City.

Noting that this is "a move that recognizes the high demand for housing finance in the country," BML Islamic said that " it will support individuals and families across the country."

BML Islamic's Director, Zulkarnain Taman said that their customers will now be able "to apply for Shari’ah-compliant home construction and real estate financing facilities from today onwards."

"I know this will be welcomed news in the community especially for our customers looking for banking solutions in accordance with Shari’ah-compliant principles," said the Director, adding that the company looks forward "to funding homes across the country to meet our customers’ demands."

Launched in January 2015, BML Islamic is fully Shari’ah-compliant and has been developed according to international standards and best practices for Islamic banking.

Customer deposits are maintained in a separate fund that is utilized exclusively for Shari’ah-compliant purposes, and this process is overseen by the Bank’s Shari’ah Advisory Committee, which includes internationally recognized experts, BML revealed.